When you are a business owner, there are things that you have time for, and things that you don't.

Customers and growing your business - Yes.

Sorting through paperwork and spending hours on the phone organising finance - No.

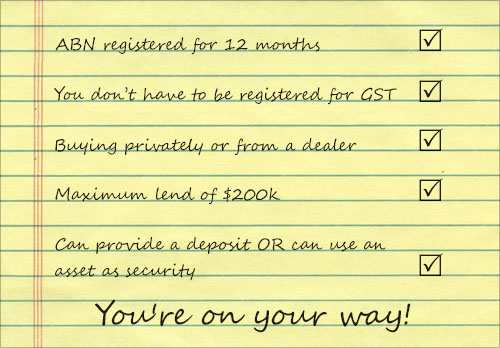

When you're time poor, or lack the paperwork necessary for a regular loan, a Low Doc loan can be the saviour of the business owner.